What we do

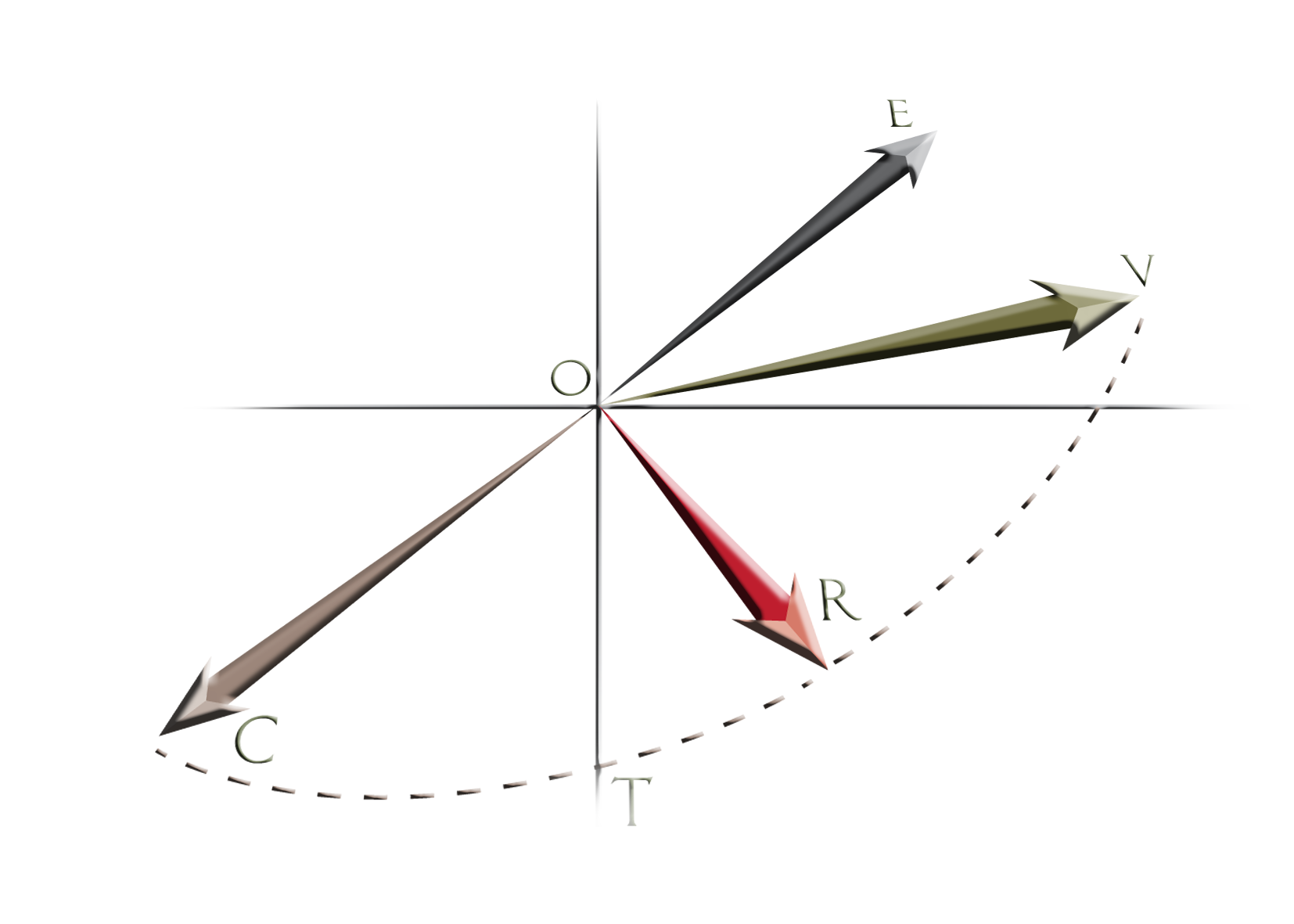

Vector Partners provides specialist corporate finance advice in the following key areas:

- Capital-raising, private placements

- Financial restructuring, arrangement of debt packages

- Mergers, acquisitions, privatisations, disposals, auctions, joint ventures

- Leveraged buy-outs, management buy-ins, private equity

- Project financing and public-private partnerships

We have developed our services based on the team’s specific and complementary expertise in the leveraged buy-out market and the international M&A and capital markets. Within each of these specialist areas, Vector Partners assists with all relevant aspects, including general financial and strategic advice, potential buyer identification, valuation, designing and managing sale processes, management presentations, negotiations with counterparties and finance providers, bid strategies, transaction structuring, commercial/partnership/shareholder agreements, process management (auctions, due diligence etc) and coordination of other advisors.

Vector Partners also has access to substantial private funds which can be selectively tapped to invest or co-invest in deals in which it is involved. These are based on privileged relationships that the principals hold with selected private and family groups in London, Greece, Turkey and the Middle East.

Combined with our advisory expertise, this access to funds allows us to come up with fresh, creative, tailored and value-creating solutions.

In each of the Greek, Turkish and regional markets where we specialise, Vector Partners’ principals have longstanding, in-depth experience of advisory and investment work and an extensive network of contacts in both the public and private sectors.

Selected transactions

Much of the work we have done is cross-border. We have worked with local players in their negotiations with international names such in the case of Makan (coffee brand owner and distributor), which we helped in its sale to Nestle, Rolco (detergent and personal care manufacturers), brands of which were bought out by Procter & Gamble, InfoQuest, which we advised in its acquisition of Rainbow and its relationship with Apple and Fourlis, the leading Greek retailer (owner of IKEA and Intersport franchises in Greece) which we advised in the acquisition of the Intersport franchise in Turkey.

We have also advised a set of private investors in the acquisition of Enexon Hellas, one of Greece’s leading photovoltaic energy companies, from Hideal Partners of Italy, before advising them again on the sale of the company, following the development of its PV licences, to ENEL, the Italian Utility. Other notable international clients include G4S (leading security services company) which we advised in acquiring businesses in the Balkans and evaluating new business lines, ISS (leading international business services company) which we advised in the sale of its Greek Business Services activities as well as a Saudi conglomerate, which we advised in its investment and partnership in a flagship Greek luxury resort.

Our hospitality industry experience, subsequently extended to advising a consortium between TEMES and Turkish conglomerate Dogus in the successful acquisition of the Athens Hilton hotel as well as the acquisition of a majority stake in the Sbokos Hotel Group by a Vassilakis Group vehicle.

FEES AND EXPENSES

Each situation is different and we will provide a tailored fee proposal depending on the particular nature of each project and client. However, the basic building blocks involve: strong incentivisation through an appropriate success fee; an element of fixed monthly retainer fee to ensure commitment and cover part of our work in the event of non-completion; and reimbursement of out-of-pocket expenses.

EXCLUSIVITY

Vector Partners commits to its clients not to undertake any other project or involvement in the client’s sector of activity throughout the length of any assignment without the client’s express permission. This ensures absolute exclusivity to a client while avoiding any potential conflicts of interest.

We maintain the highest standards of professionalism in all aspects of our work, but nowhere more so than where confidentiality is concerned.